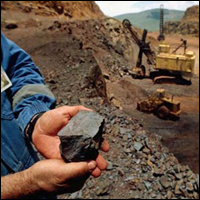

Despite a sharp fall in international iron ore prices due to weakening of demand from China and prospects of higher supply as a result of capacity expansions by large global mining companies, domestic iron ore prices in India show a reverse trend reflecting the continuing short supply situation in the country. International iron ore prices declined in recent months to around $90-100 per tonne from $120 per tonne in February 2014.

A recently released report on the Indian steel industry by ICRA observed that domestic iron ore was expected to be in short supply for steelmakers without captive sources, at least in the near term.

The report said that even though the ban on mines in Goa and Karnataka had been lifted, the shortage in supply of domestic iron ore remained. The temporary closure of iron ore mines in Odisha further aggravated the short supply situation, it added.

| PRODUCTION OF STEEL | |||||||||||||||

|

|||||||||||||||

With regard to the iron ore mines in Odisha, the report said that although the mines of Tata Steel Ltd, Odisha Mining Corporation and Steel Authority of India Ltd, which were initially under the purview of the ban, had been allowed to operate, production was yet to resume at other merchant mines in the state which accounted for around 15-20 million tonnes of iron ore production in FY14.

| DEMAND AND SUPPLY OF STEEL | ||||||||||||

|

||||||||||||

The report said that given the shortage in supply of domestic iron ore and the cost disadvantages in importing iron ore, the capacity utilisation of steelmakers without captive sources was likely to get affected. It added that the price increases in the aftermath of the temporary closure of iron ore mines in Odisha were likely to adversely affect the raw material costs of steelmakers. ICRA noted in the report that an upward revision of royalty rates on minerals, as announced by the government in August 2014, and the hike in railway freight rates, were further going to impact the cost structure of steel players. The increase in clean energy cess on coal, which was imposed by the Union Budget, would lead to increase in costs for domestic sponge iron players, the report said. It pointed out that rising international scrap prices since March 2014 would increase raw material costs of many secondary steel producers.