Orient Bell Ltd. today announced its unaudited financial results for the quarter ended Sep 30, 2020.

Orient Bell Ltd. today announced its unaudited financial results for the quarter ended Sep 30, 2020.

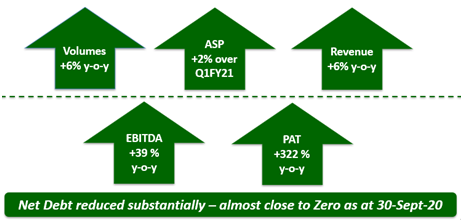

Key Highlights – Q2FY21:

- Topline growth +6% y-o-y led by renewed focus on New Products, Displays and Channel Engagements

- EBITDA margin at +8% led by concerted efforts on cash fixed costs and improvement of consumption KPI’s; EBITDA loss of Q1FY21 recouped fully during Q2FY21

- Strong focus on Working Capital management continues – Days Inventory Outstanding (DIO) and Days Sales Outstanding (DSO) improved significantly

- First ever Digital launch of New Products ~ 300 new SKU’s

(See the entire range at https://www.orientbell.com/new-tile-designs)

o Germ Free Tiles – Wall & Floor

o High Gloss Germ Free Tile – Sparkle Series300X450

o High Depth Elevation Tiles – 300X600

o New designs introduced in GVT

o 400X400 Pavers – Rhino Series

- No. of new Orient Bell Tile Boutique (OBTB’s) added during Q2FY21 – 25, total number of active OBTB’s as on 30-Sep-20 increased to 188

- Marketing investments restored during Q2FY21 – 1.3% of topline (~2.6X of Q1FY21 spend)

- Sale from High Value Products (HVP) increased to 41%. Own Manufacturing sales increased to ~68% of total revenue