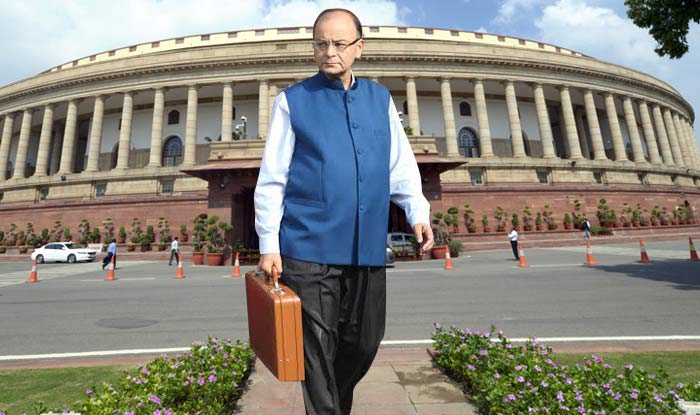

The union budget 2015-16 presented by the Finance Minister, Arun Jaitley on 29 February has focused on rural development, infra, particularly railways and roads, and bank recapitalization to make them healthier. Farm sector and farmers have been badly hit by two consecutive monsoon failures and government had to come to their succor on economic and political grounds. Thus, rural development gets Rs 87,765 crore with interest subvention, fasal bima yojana, MGNREGS, Pashudhan Sanjivani, etc, specific allocations Investment on roads and railways can act as catalyst for investment spiral so there has to be substantial pumping in of funds. Pradhan Mantri Gram Sadak Yojana, NHAI etc get Rs 97,000 crore. Railways have earlier announced Rs 125000 crore plan outlay, Public sector banks are in financial stress as they are engaged in cleaning up their balance sheets of stressed loan accounts and hence they needed capital support; so there is a provision of Rs 25000 crore for this.

However, with private sector corporate balance sheets still stressed and global markets as also commodity prices not investment conducive in several industries on the one hand, and banks preoccupied with balance sheet cleaning (of NPA) and hence not eager to fund large, gestation projects, the private sector investment is likely to restrained during 2016-17. Viewed in this light, the Budget could have deferred FRBM targets for one more year and given more space for budget funded capex, In fact, capex of the Central government would rise 2.3 per cent only during 2016-17 on BE/RE and decline 1.5 per cent on BE/BE. This compares poorly with 23 per cent rise in 2015-16 and 8+ per cent average in earlier two years. This compares poorly also with around 11 per cent increase expected in the GDPmp in the next year.

In keeping with recent trends, the Budget has depended more on non-tax receipt, including PSU equity disinvestment than on tax receipt to raise non-debt receipt. Thus, net tax receipt would rise 15 per cent, whereas non-tax revenue receipt would shoot up 46 per cent on the back of telecom spectrum auctions. Total expenditure would rise 11 per cent. Bulk of the rise would be in revenue account, with capex accounting for just around 2-3 per cent of the incremental disbursement.

There is no mention in the budget about the 12th Plan, which would be into terminal year in 2016-17. In fact, the finance minister has proposed to do away with Plan and Non-Plan classification of disbursements from next year.

The finance minister has projected 7-7.75 per cent real growth and 11 per cent in nominal terms, which is more relevant for several of budget numbers, particularly in tax, non-tax receipt for 2016-17.