-

- Total Income increased by 5% to Rs. 266.96 Crores from Rs. 254.32 Crores

- Consolidated EBITDA stood at Rs. 69.68 Crores as compared to Rs. 71.45 Crores

- Consolidated EBITDA margin stood at 26.1% viz-a-viz 28.1%

- CFS operational EBITDA at Rs. 26.43 Crores as compared to Rs. 27.93 Crores

- Rail operational EBITDA at Rs. 42.94 Crores as compared to Rs. 41.0 Crores

- Further prepaid NCDs of Rs. 118.19 Crores (including interest) during the quarter

Mumbai, October 29th, 2020: Gateway Distriparks Limited (GDL) a leading integrated inter-modal logistics facilitator in India today announced its unaudited financial results for the quarter and half year ended September 30th, 2020.

Key Consolidated Financial Highlights:

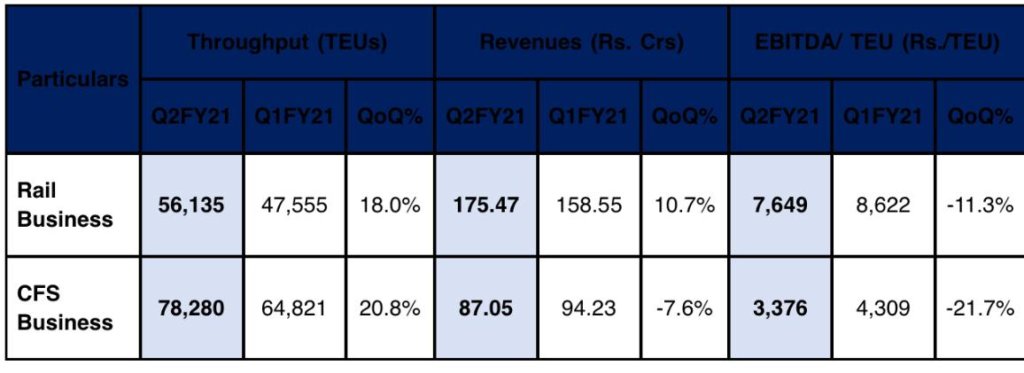

Particulars (Rs. Crs) Q2FY21 Q1FY21 Total Income 266.96 254.32 EBIDTA 69.68 71.45 EBIDTA Margin 26.1% 28.1% PBT 15.15 15.04 PBT Margin 5.7% 5.9% PAT 4.26 11.12 PAT Margin 1.6% 4.4% Key Operational Highlights:

Other Highlights:

Other Highlights:- Prepaid total NCDs of Rs. 118.19 Crores (including interest) in Q2 FY21

- Net Debt as on September 30, 2020 stands at Rs. 509 Crores against Rs. 681 Crores as on March 31, 2020

- Gateway Rail Freight Limited Q2 FY21 financial performance:

- Revenues were Rs. 175.47 Crores

- EBITDA was Rs. 42.94 Crores and EBITDA margin stood at 24.5%

- PAT was Rs. 17.24 Crores and PAT Margin stands at 9.8%

- CFS business Q2 FY21 financial performance:

- Revenues were Rs. 87.05 Crores

- EBITDA was Rs. 26.43 Crores with an EBITDA margin of 30.4%

- Net Loss (after tax, including on dividend income) was Rs. 11.44 Crores

- Snowman Logistics Q2 FY21 financial performance:

- Revenues were Rs. 57.69 Crores

- EBITDA was Rs. 14.80 Crores and EBITDA margin stood at 25.7%

- Net Loss was Rs. 1.70 Crores

Rights Issue and Debt reduction

In August 2020, the company successfully raised Rs. 116 crore via rights issue. The fund proceeds were used towards prepayment of NCDs totalling to Rs. 118.19 Crores (including interest). The consolidated debt has now reduced from Rs. 681 Crores as on March 31, 2020 to Rs. 509 Crores as on 30th September 2020.

Business Restructuring

In September 2020, the Board of Directors of the Company have approved the proposed composite scheme of amalgamation to reverse merge Gateway Distriparks Limited (GDL) into its subsidiary Gateway Rail Freight Ltd (GRFL). Post this restructuring exercise, GDL would be delisted and GRFL would be listed and renamed later. The rationale behind the business restructuring is to drive operational synergies and cost efficiencies, improve cash flows and debt servicing ability of the new merged entity GRFL and reduce statutory and regulatory compliances. This step goes in line with company’s yearlong effort targeted to unlock value while aggressively eyeing reduction of debt.

Commenting on the performance, Mr. Prem Kishan Dass Gupta, Chairman & Managing Director, commented,

“First I would like to thank our shareholders for supporting the rights issue. Through our internal accruals and money raised through rights issue, we have completed prepayment of A1 series NCDs totalling to Rs. 250 crores since January 2020. This significant deleveraging of our balance sheet will allow us to focus on future growth opportunities through capex towards satellite rail terminals.

The business restructuring will enhance our future cash flows significantly and provide us flexibility for ramping up our business operations. The new structure will enable us to grow our Rail intermodal logistics business faster and capitalize on new growth opportunities. This restructuring enables the company to realize its full potential, whilst rationalizing the cost base which will create value for all our shareholders. Restructuring will also enable us to remain focused on operational and technological advances to maintain and extend our leadership positions.

Industry dynamics dictates that rail transport will continue to gain transportation share at the cost of the road mode. Government also recognises that modal shift from road to rail freight has significant potential to help improve efficiency for transportation of goods as well as reduce carbon emissions. Ministry of Railways recently announced that it is proactively taking efforts and working aggressively to attract wider share of freight with an aim to increase its modal share of freight to up to 40%. This shall benefit us due to our multimodal capabilities to cater our customers who are increasingly demanding integrated logistics solutions.

The performance for the quarter has been as per our expectations. We continue to see a month on month improvement in business parameters thereby gives us hope of sustained recovery over the future quarters. A robust Balance Sheet combined with our strategically located state of the art infrastructure alongside the Western DFC will help us to capitalize on the future growth opportunities.”