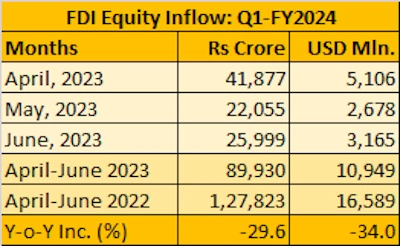

Foreign direct investment (FDI) into India declined 34% to $10.94 billion during April-June 2023-24 (Q1FY24), dragged by lower inflows in computer hardware and software, telecom, auto and pharma, according to the latest data released by the Department for Promotion of Industry and Internal Trade (DPIIT).

FDI inflows stood at Rs 16.58 billion during April-June 2022-23. Inflows during January-March 2023 too had contracted 40.55% to $9.28 billion. Investments from overseas fell in April, May and June this fiscal to $5.1 billion, $2.67 billion and $3.16 billion, respectively as against $6.46 billion, $6.15 billion and $3.98 billion in the year-ago corresponding periods, the data from DPIIT showed.

Total FDI, which includes equity inflows, reinvested earnings and other capital, contracted 21.4% to $17.56 billion during the period under review as against $22.34 billion in April-June 2022.

Sector wise, inflows contracted in computer software and hardware, trading, telecommunication, automobile, pharma and chemicals.

FPIs invest Rs 10,689 crore in Aug 2023

In the meatime, after strong foreign fund flows into Indian stocks over three months, the pace of FPI inflows too ebbed in August with a net investment of Rs 10,689 crore on higher crude oil prices and resurfacing of inflation risks. Further, markets could remain volatile in the coming week due to macroeconomic uncertainty and rising US bond yields. This has been prompting FPIs to flee emerging market equities, including India, and park funds in US securities.

After infusing a staggering amount in Indian equities in the past three months, the pace of inflow from foreign investors ebbed in August with a net investment of Rs 10,689 crore on higher crude oil prices and resurfacing of inflation risks. Further, markets could remain volatile in the coming week due to macroeconomic uncertainty and rising US bond yields.

Foreign Portfolio Investors (FPIs) invested a net amount of Rs 10,689 crore in Indian equities this month (till August 26). This figure includes investment through the primary market and bulk deals. Before this investment, FPIs invested over Rs 40,000 crore each in the past three months in Indian equities.