The Government of India has envisaged an investment of $12 billion in the airport sector during the ongoing 12th Plan period. The rapidly expanding air transport network and opening up of infrastructure to private sector participation have fuelled the growth of air traffic in the country. The Indian airport system is gearing up to handle 336 million domestic and 85 million international passengers by 2020, making India the third largest aviation market in the world.

India’s underdeveloped aviation sector offers immense potential to both domestic and foreign investors, especially since over a third of world trade by value and about half of international tourism is facilitated by air links. Besides, in a world of decreasing barriers to trade, the civil aviation industry remains a unique engine for innovation and technological progress, one that provides infrastructure that keeps the nation competitive.

“Civil Aviation is a key infrastructure sector that facilitates the growth of business, seamless flow of investment, trade and tourism, with significant multiplier effects across the economy. The aviation sector is one of the prime movers for economic growth and a strategic element of employment generation, besides providing air transport for passengers and goods,” Civil Aviation Minister Ajit Singh said, emphasising the importance of the sector.

In order to boost air connectivity, airlines are expected to add around 370 aircraft worth $27 billion to their fleet by 2017. Commercial fleet size is expected to go up from 400 today to 1,000 by 2020. Another 1,000 general aviation aircraft are expected by 2020 which includes fleet renewal. The estimated investment requirement for general aviation aircraft alone is of the order of $4 billion.

In order to boost air connectivity, airlines are expected to add around 370 aircraft worth $27 billion to their fleet by 2017. Commercial fleet size is expected to go up from 400 today to 1,000 by 2020. Another 1,000 general aviation aircraft are expected by 2020 which includes fleet renewal. The estimated investment requirement for general aviation aircraft alone is of the order of $4 billion.

Ajit Singh said, “The Indian government has envisaged investment of $12.1 billion in the airports sector during the 12th Plan period, of which $9.3 billion is expected to come from the private sector for construction of new airports, expansion and modernisation of existing airports, development of low-cost airports to keep the tariff at a minimal at smaller airports, and development of world-class air navigation services infrastructure.”

To begin with, the government is accelerating the modernisation and development of the civil aviation sector by privatising six major airports in PPP mode. These are Chennai, Kolkata, Ahmedabad, Jaipur, Guwahati and Lucknow airports. The Airports Authority of India has already invited RfQ from eligible companies for operation, management and transfer of these airports (read full story at www.projectsmonitor.com/tag/privatisation-of-airports).

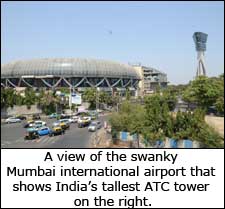

The privatisation of the six airports will replicate the success of the privatisation of the Delhi (GMR Group) and Mumbai (GVK group) international airports. This excludes the development of greenfield airports by private investors in Hyderabad (GMR again) and Bengaluru (GVK-Unique Zurich-Siemens Projects Ventures).

As Minister of State for Civil Aviation K.C. Venugopal told Parliament, “After awarding the Delhi and Mumbai airports to joint venture companies, namely Delhi International Airport Pvt. Ltd and Mumbai International Airport Pvt. Ltd respectively, it has been observed that the introduction of PPP model at these airports has led to a significant improvement in the infrastructure and rise in the collection of revenues, especially non-aeronautical revenues,”

The Ministry of Civil Aviation also anticipates huge investment in the development of world-class ground handling, cargo and logistics facilities including high output distribution centres at major airports.

The government has introduced several policies and regulatory reforms to encourage private participation and investments in the aviation sector which, however, faces challenges in the form of rising fuel costs, fierce competition and infrastructure bottlenecks. The government recently permitted 49 per cent FDI by foreign carriers in domestic airlines to provide much-needed relief to the domestic aviation industry reeling from mounting losses and rising debt. Further, Indian carriers have been allowed to import ATF directly.

|

TOP 10 ONGOING AIRPORT PROJECTS IN PRIVATE SECTOR

|

||||||

|

Promoter

|

Project

|

Cost (` Crore)

|

Ownership

|

Location

|

District

|

State

|

| City & Industrial Development Corporation Maharashtra Ltd |

International Airport (Navi Mumbai) Project

|

14,573

|

State

|

Panvel

|

Raigarh

|

Maharashtra

|

| Mumbai International Airports Pvt. Ltd |

Mumbai Airport Project – Modernisation

|

12,380

|

Private (Indian)

|

Mumbai

|

Maharashtra

|

|

| Maharashtra Airport Development Company Ltd |

International Airport (Pune) Project

|

7,500

|

State

|

Chakan

|

Pune

|

Maharashtra

|

| Maharashtra Airport Development Company Ltd |

Nagpur International Passenger & Cargo Hub Airport Project, Phase-I

|

5,000

|

State

|

Nagpur

|

Maharashtra

|

|

| Government of Goa |

International Airport (Mopa) Project

|

3,800

|

State

|

Mopa

|

North Goa

|

Goa

|

| Kannur International Airport Ltd |

Kannur International Airport Project

|

3,199

|

State

|

Moorkhanparambur

|

Kannur

|

Kerala

|

| Airports Authority of India |

Airport (Hassan) Project

|

3,000

|

Central

|

Hassan

|

Karnataka

|

|

| Airports Authority of India |

Airport (Dholera) Project

|

2,500

|

Central

|

Dholera

|

Ahmedabad

|

Gujarat

|

| Government of Gujarat |

Airport (Ankleshwar) Project

|

2,500

|

State

|

Ankleshwar

|

Bharuch

|

Gujarat

|

| Government of Gujarat |

Airport (Dwarka) Project

|

2,500

|

State

|

Dwarka

|

Jamnagar

|

Gujarat

|

The Ministry of Civil Aviation has also taken measures to provide affordable air connectivity to remote and interior parts of the country, such as the northeastern region and Tier II & III cities.

On the other hand, the ministry is making the MRO segment (maintenance, repair and overhaul) more competitive to attract investment and thereby growth. For instance, Budget 2013-14 has a provision for several concessions for MRO including extension of time period allowed for utilisation of aircraft parts and equipment from three months to one year and exemption of custom duty on parts, equipment, accessories and spares. These and other concessions have been welcomed by the industry.

In light of the growth prospects of air traffic, potential for large-scale acquisition of aircraft and substantial investment projections, the Indian aerospace market offers lucrative long-term opportunities for providing MRO and ground handling services, manpower training, building of an efficient airspace and air traffic management system, air cargo services, and establishing aircraft design and manufacturing centres.

Further, currently, the air travel penetration in India is 0.04 air trips per capita per annum which is far behind developed countries like USA and Australia (more than 2 air trips per capita per annum), and China and Brazil (0.3 air trips per capita per annum). The gap between potential and current air travel penetration underscores the potential for air traffic growth in India.

“India’s aviation scenario is fast changing and poised to break boundaries and scale new heights. With ever-increasing scope for participation by private sector, we expect significant developments in the years ahead,” Civil Aviation Minister Ajit Singh added.