In her Interim Budget 2024-25, the finance minister, Nirmala Sitharaman, has left the tax rates (direct and indirect) unchanged. However, to ensure the continuation of the infrastructure building activities, enhanced the capex budget allocation by 11 percent. To ensure economic development at the state level, a corpus of Rs 75,000 crore will be created. Under this scheme, states that adopt reforms will be eligible to avail interest-free long-term loans.

The Interim Budget for 2024-2025 outlines a progressive and inclusive approach to development. Food security concerns have been addressed through free ration distribution to 80 crore people, and minimum support prices for farmers. The government feels that these measures, coupled with the provision of necessities, have boosted real income in rural areas, stimulating economic growth and job creation.

Infrastructure Development

The capital expenditure outlay has been increased by 11 percent to Rs 11,11,111 crore, equivalent to 3.4 percent of the GDP. The railway sector will see the implementation of major economic corridors to improve logistics and passenger comfort. Around 40,000 railway bogies will be converted to the Vande Bharat standards. The finance minister announced her government’s support to build an ecosystem for EV manufacturing and increase the number of battery charging stations.

The aviation sector, with the doubling of airports and expansion under the UDAN scheme, continues to thrive. Metro and NaMo Bharat will transform urban centres, while green energy initiatives aim to meet climate goals.

To support a major expansion in chip and electronics manufacturing, the budget proposes a 71.4 percent increase in allocation to these sectors to Rs 13,104.5 crore.

Research and Innovation

A corpus of Rs 1 lakh crore was set aside to encourage research and innovation in sunrise domains like artificial intelligence (AI), 5G, and quantum computing, with a focus on defense technologies.

Rural Infrastructure

To revive the rural demand, the government intends to build three crore houses under the PM Awas Yojana (Grameen). Rooftop solarisation, to be executed under the Pradhan Mantri Suryodaya Yojana with a budgetary allocation of Rs 10,000 crore, will provide one crore households with up to 300 units of free electricity monthly. Additionally, a new scheme will be formalised to aid the middle class in owning or building their own homes.

Healthcare and Education

The government proposes to establish more nursing and medical colleges using the existing hospital infrastructures. Girls aged between 9 and 14 will receive cervical cancer vaccination. Maternal and child healthcare will be streamlined to deliver more healthcare services, and Ayushman Bharat healthcare coverage will extend to ASHA workers, Anganwadi Workers, and Helpers.

Agriculture and Food Processing

Efforts to enhance agricultural value addition, farmers’ income, and reduce post-harvest losses will be intensified. Nano DAP will be expanded, and Atmanirbhar Oil Seeds Abhiyan will focus on self-sufficiency in oilseed production. The Matsya Sampada Yojana aims to double seafood exports and generate employment opportunities.

Prioritising Social Justice

The government’s commitment to social justice revolves around four key categories: the ‘Garib’ (poor), ‘Mahilayen’ (women), ‘Yuva’ (youth), and ‘Annadata’ (farmer). Empowering these groups has been a primary focus. The previous approach of addressing poverty through entitlements yielded limited results, but now, by empowering the poor, the government has helped 25 crore individuals break free from multidimensional poverty.

The ‘Direct Benefit Transfer’ program has played a significant role in this transformation, transferring Rs 34 lakh crore to beneficiaries through PM-Jan Dhan accounts while saving the government Rs 2.7 lakh crore by reducing leakage. The PM-SVANidhi scheme has provided credit assistance to 78 lakh street vendors, further supporting economic growth.

Annadata, Top Priority

Farmers, often referred to as ‘Annadata,’ remain a top priority. Under the PM-KISAN SAMMAN Yojana, 11.8 crore farmers, including marginal and small farmers, receive direct financial assistance annually. Additionally, 4 crore farmers benefit from crop insurance under the PM Fasal Bima Yojana. The Electronic National Agriculture Market has streamlined trade for 1.8 crore farmers, with a trading volume of Rs 3 lakh crore.

Empowering the Youth

The Skill India Mission has trained 1.4 crore youth and upskilled and reskilled 54 lakh more. New institutions of higher learning, including IITs, IIITs, IIMs, AIIMS, and universities, have been established. The PM Mudra Yojana has sanctioned 43 crore loans totaling Rs 22.5 lakh crore for entrepreneurial ventures, while Fund of Funds, Start Up India, and Start Up Credit Guarantee schemes support youth entrepreneurship.

Empowerment of Nari-Shakti

Thirty crore Mudra Yojana loans have been granted to women entrepreneurs. Female enrollment in higher education has increased by twenty-eight percent in the last decade, with girls and women comprising forty-three percent of STEM course enrollment.

Lakhpati Didi, a program recognizing the achievements of self-help groups (SHGs) and women empowerment, aims to expand from 2 crore to 3 crore beneficiaries.

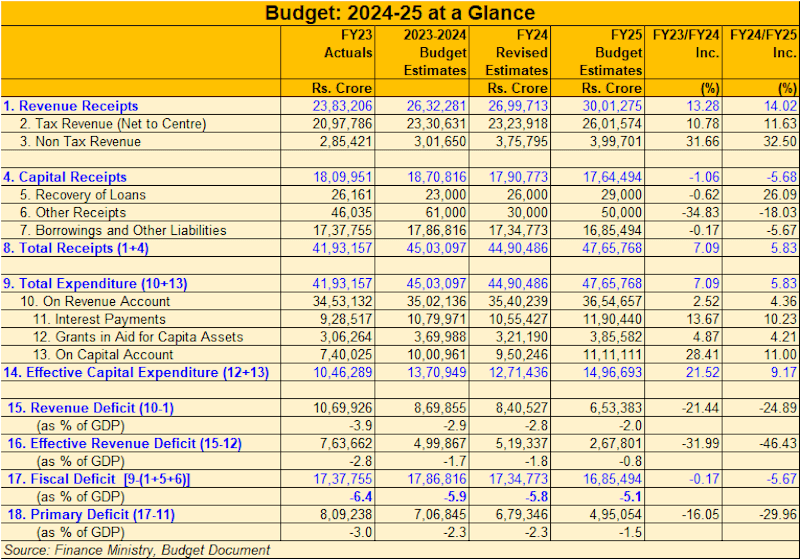

Fiscal Outlook

The government expects the fiscal deficit for 2023-24 to be at 5.8 percent of GDP and all efforts will be made to reduce it further to 5.1 percent of GDP in 2024-25. The deficit is expected to come down further to 4.6 percent in 2025-26.

Tax Proposals

Being an interim Budget, the finance minister has desisted from changing any of the direct or indirect tax rates. However, to support start-ups and investments by sovereign wealth or pension funds, tax benefits will be extended to 31 March 2025. Further, under the tax reforms measures, the outstanding direct tax demands up to Rs 25,000 for the period up to the financial year 2009-10 and up to Rs 10,000 for financial years 2010-11 to 2014-15 will be withdrawn, benefiting approximately one crore taxpayers.