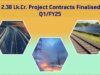

India’s merchandise trade deficit increased by around $6 billion to $39.2 billion during October-December 2014, following slackening export on the one hand and rising import, particularly non-POL import, on the other. Mirroring eroding global crude oil prices, POL import declined by around 19 per cent. Service receipt managed to finance around one-third of trade account deficit increase, as a result of which current account deficit escalated by $4 billion to $8.2 billion. The outgo on account of primary income and the receipt on account of secondary income (mainly workers’ remittances) remained at the year-ago level. The quarter saw a net addition of $13.2 billion to forex reserves, as a result of $7.4 billion received in FDI, $6.3 billion in portfolio investment and $3.6 billion in NRI deposits.

Trends over April-December

The country’s current account deficit declined by $5 billion to $26 billion during April-December 2014-15 mainly due to truncated merchandise trade deficit following reduced POL import bill. CAD formed 1.7 per cent of GDPmp over the period, lower compared to 2.3 per cent during the similar period 2013-14. CAD mirrors foreign capital inflow in the form of net absorption of foreign goods and services in the economy, which supplements domestic saving to fund projects investment in the country. By the way, the net increase in invisibles failed to cover fully the increase in trade account deficit during April-December. The increase in service income was broadly matched by enhanced outgo in dividend, profits repatriation, whereas secondary income remained at the year-ago level.

The country’s forex reserves went up by $31.3 billion over the first three quarters of 2014-15, which was nearly four times the increase during the corresponding period of 2013-14. However, it may be noted that the performance last year was after a steep draw-down of $10.7 billion in forex reserves during a relatively abnormal H1 of 2013-14. Among the capital receipts, FDI was $23.8 billion ($20.7 billion), portfolio investment $28.5 billion (pullout of $4.4 billion), and NRI deposits $10.1 billion ($35.1 billion).

The valuation loss, mainly reflecting the appreciation of the US dollar against major currencies along with the decline in the international price of gold, amounted to $14.8 billion during April-December 2014 as compared with $6.6 billion during the same period of preceding year. This resulted in a lower increase of $16.5 billion ($1.8 billion) in forex reserves in nominal terms over the period.

|

BALANCE OF PAYMENTS DURING APRIL-DECEMBER

|

||

|

($ Billion)

|

||

|

2014-15

|

2013-14

|

|

|

Trade Balance

|

-112.5

|

-116.9

|

|

Net Services

|

56.4

|

53.4

|

|

Primary Income, Net

|

-19.4

|

-16.6

|

|

Secondary Income, Net

|

49.3

|

49

|

|

Current Account Balance

|

-26.2

|

-31.1

|

|

Capital and Financial Account

(including e&o, & forex reserves) |

26.2

|

31.2

|

|

Direct Investment (net)

|

23.8

|

20.7

|

|

Portfolio Investment

|

28.5

|

-4.4

|

|

NRI Deposits

|

10.1

|

35.1

|

|

ECB

|

5.2

|

6.7

|

|

Banking Capital

|

-0.1

|

-7.9

|

|

Short term trade credit, etc

|

-2.7

|

-0.6

|

|

Other receivables/payables

|

-7.9

|

-10.2

|

|

External Assistance

|

0.9

|

0.1

|

|

Increase in Reserves (on BoP account)

|

31.3

|

8.4

|

|

Valuation Change

|

-14.8

|

-6.6

|

|

Change in Reserves

|

16.5

|

1.8

|

|

Note: Increase in reserves reflect their investment

and hence capital outflow; reverse would be reflected in decline in reserves. |

||