Investment in India recorded a notable increase in the first quarter of FY2024, with a growth rate of 32.87 percent compared to the previous year. The Government sector dominated the Projex (projects expenditure) arena this quarter, as both the Central and State governments ramped up their capital expenditure. However, the Private sector, which had announced record investment intentions in the preceding quarter, moderated its commitments in Q1/FY24. Despite ongoing political uncertainty, Maharashtra emerged as the top state in terms of the number of planned projects and investments.

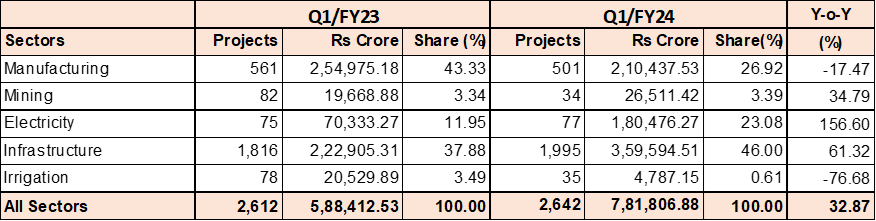

According to the 91 Survey of Projects Investment in India, the first quarter of FY2024 witnessed the announcement of 2,642 new projects with a total investment value of Rs 7,81,806.88 crore. In the same period a year ago, 2,612 projects were announced, amounting to a total investment commitment of Rs 5,88,412.53 crore. This represents a healthy growth rate of 32.87 percent on a year-on-year basis.

The previous quarter, Q4/FY23, saw a significant surge in project investment across major sectors in India, with a staggering 167.27 percent increase compared to the previous year. While the private sector continued to dominate the investment landscape, the public sector also increased its investment commitments. Overall, 2,779 new projects were announced during the quarter, totalling Rs 14,60,955.67 crore.

Manufacturing, which had been the leading sector in terms of capital expenditure in recent quarters, witnessed a decline in both the number of new projects and fresh investment commitments in Q1/FY24. Fresh investment in the Manufacturing sector decreased by 17.47 percent on a year-on-year basis, accompanied by a decrease in the number of projects from 561 to 501. Consequently, the sector’s share of total investment dropped from 43.33 percent to 26.92 percent between the two quarters. The decline can be attributed to a decrease in mega projects as well.

Despite the downward trend in manufacturing, certain sectors showed resilience. Food products, Petrochemicals, Cement, and Automobiles experienced positive growth, while Drugs & Pharma, Basic Metals, and Electronics encountered significant declines.

The Mining sector witnessed a substantial increase in investment, with a growth rate of 34.79 percent year-on-year, despite a decrease in the number of projects. This growth was driven by the addition of six mega-value projects, including a lignite mining project in Odisha and oil exploration projects in Andhra Pradesh, Gujarat, and Assam.

In the Electricity sector, Q4/FY23 witnessed the announcement of numerous mega projects related to green hydrogen and semiconductors. However, in Q1/FY24, the focus shifted to large-scale Hydel-based pumped storage power projects. The quarter saw the announcement of 33 Hydel power projects, aiming to generate around 40,000 MW of new power capacity. Additionally, 41 Solar, Wind, and Solar+Wind projects with a total generation capacity of 7,085 MW were announced, bringing in fresh investment of Rs 34,257.30 crore. Overall, the sector experienced a growth rate of 156.60 percent compared to the previous year, with a total of 77 new projects announced.

The Power Distribution sector also witnessed increased capital expenditure during the first quarter, with the announcement of 89 new projects worth Rs 14,346 crore.

In the Infrastructure sector, the Transport and Social Infrastructure sectors maintained their dominance in terms of capital expenditure. The quarter saw the announcement of 1,995 new projects with a combined investment of Rs 3,59,594.51 crore, reflecting a healthy growth rate of 61.32 percent compared to Q1/FY23. Star performers within this sector included Roadways, Railways, Shipping Infra, Construction, and Data Centres.

The National Highways Authority of India (NHAI) announced 22 highway projects during the quarter, with the most expensive project being the Pulimath-Angamaly project in Kerala. Additionally, various state-owned road building agencies and Public Works Departments (PWDs) announced around 400 road projects.

The Railways sector saw announcement of 42 new projects, including station renovation and upgradation projects. The largest project was the Faridabad-Palwal metro line in Haryana. The Construction sector, encompassing Real Estate, Commercial Complexes, Shopping Plazas, Hospitals, Hotels, and Industrial & IT Parks, witnessed the announcement of 778 new projects.

The Real Estate sector emerged as a major player, experiencing consistent growth in recent quarters. During Q1/FY24, 495 new Real Estate projects were launched, representing a total investment of Rs 81,568.26 crore and a healthy growth rate of 46.33 percent compared to the previous year. The Data Centre segment also saw significant announcements, with nine new projects announced during the quarter and a total investment of Rs 11,715.74 crore. As of June 30, 2023, there were 148 Data Centres under development in India, with a combined cost of Rs 2,04,670 crore.

However, the Irrigation sector witnessed a sharp decrease in investment, dropping by 76.68 percent year-on-year. Both the number of new projects and planned investment declined significantly, with only 35 new projects announced during the survey period. In comparison, 78 new projects worth Rs 20,529.89 crore were announced in the same period the previous year.