95th Projects Investment Survey

Private Investment Prevents Steeper Fall

Fresh investment in the first quarter of FY2025 (Q1/FY2025) declined by 27.08 percent on a Y-o-Y basis, due to the prolonged General and State elections, which impacted the fresh investment announcements by the Central and State agencies. Despite the political uncertainty, that generally prevails during the General election period, the Private sector posted positive growth in new projects. Among the states, Maharashtra managed to attract one-fourth of the total fresh investment announced in the first quarter of the current fiscal year.

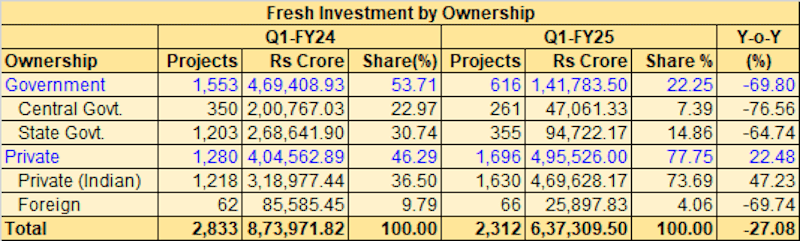

According to the 95th Survey of Projects Investment in India, conducted by Projects Today, Q1/FY2025 witnessed the announcement of 2,312 new projects worth Rs 6,37,309.50 crore. In the same period, a year ago, the country saw the announcement of 2,833 new projects with a total investment commitment of Rs 8,73,971.82 crore. This indicated a sharp fall of 27.08 percent on a year-on-year basis.

Projex by Ownership

The disruption caused by the General and State elections resulted in reduced fresh investments by Central and State-controlled agencies. During the election period, the government agencies were barred from announcing any major new investment proposals. Alongside the Central government, major states like Andhra Pradesh, Odisha and Arunachal Pradesh were also engaged in the election process.

As a result, during Q1/FY2025, fresh investment declined sharply by 69.80 percent in the Government sector. As against 1,553 projects worth Rs 4,69,408.93 crore in Q1/FY2024, only 616 projects worth Rs 1,41,783.50 crore were announced in Q1/FY25. Consequently, the Government sector’s share in total fresh investment more than halved from 53.71 percent to 22.25 percent.

Within the Government sector, the year on fall was deeper at 76.56 percent in the Central government sector. During the first quarter, the Central Government agencies announced 261 new projects worth Rs 47,061.33 crore in Q1/FY2025, prominently down from 350 projects worth Rs 2,00,767.03 crore in Q1/FY2024. The State government agencies announced 355 new projects worth Rs 94,722.17 crore in Q1/FY2025, compared to 1,203 projects worth Rs 2,68,641.90 crore in Q1/FY2024, indicating a decline of 64.74 percent.

But for the increased investment commitments by the Private sector during Q1/FY2025 the decline in fresh investment would have been steeper. During this period, a total of 1,696 new projects were announced, valued at Rs 4,95,526.00 crore, compared to 1,280 projects worth Rs 4,04,562.89 crore in Q1/FY2024, marking an increase of 22.48 percent. As a result, the private sector’s share in total fresh investment rose from 46.29 percent to an impressive 77.75 percent. Notably, the Private sector dominated major sectors like Manufacturing, Mining, Electricity, and Infrastructure, accounting for a share of 99.66 percent, 62.18 percent, 73.60 percent, and 74.80 percent of the total fresh investment, respectively.

Projex By Sector

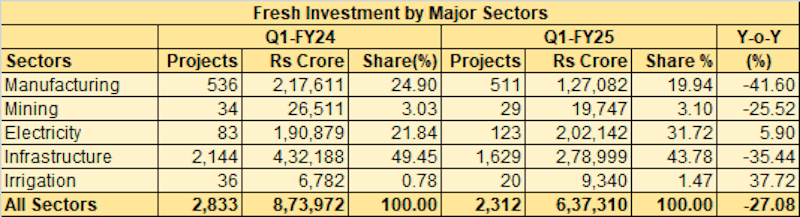

Manufacturing, Infrastructure, and Mining experienced sharp declines in fresh investment announcements year-on-year. Conversely, the Electricity sector posted a positive growth rate of 5.90 percent. The Irrigation sector’s substantial growth of 37.72 percent, was driven by two mega projects valued at Rs 7,613 crore.

The Manufacturing Sector, in Q1/FY2025, saw the announcement of 511 new projects worth Rs 1,27,081.65 crore. This indicated a substantial decline of 41.60 percent compared to a year ago announcement of 536 projects worth Rs 2,17,611.47 crore. Consequently, the sector’s share in total fresh investment decreased from 24.90 percent in Q1/FY2024 to 19.94 percent in Q1/FY2025. Textiles, Drugs & Pharma, Plastic Products, Aluminium, Cement, and Electronics sectors attracted sizeable new investment within this sector.

The 12 new Cement projects intend to add around 46 mln. tpa of cement capacity in the next couple of years. Sanghi Industries and Ambuja Cements, both part of the Adani Group, plan to establish 10 million tonnes per annum (tpa) cement capacities each in Gujarat and Chhattisgarh, respectively at a total investment of Rs 12,890 crore.

In the Metals sector, Lloyds Metals & Energy plans Rs 5,852 crore investment in a new pellet production facility in Ghugus, Maharashtra and Epsilon Advanced Materials is investing Rs 5,000 crore in a new cathode production facility.

In the Electronics sector, Tel Components plans to set up a new mobile phone manufacturing facility in Tamil Nadu, at a cost of Rs 6,751 crore. In Telangana, Kaynes Semicon proposes establishing a green-field semiconductor assembly and testing facility with an investment of Rs 2,850 crore.

Mining Sector, despite attracting three mega projects, posted a sharp fall of 25.52 percent on a year-on-year basis. In all, 29 new projects worth Rs 19,746.69 crore were announced in Q1/FY2025, compared to 34 projects worth Rs 26,511.42 crore in Q1/FY2024.

The Electricity sector saw a positive growth of 5.90 percent on a year-on-year basis, with 123 new projects worth Rs 2,02,141.96 crore announced in Q1/FY2025. The increased investment lifted the sector’s share in total fresh investment from 21.84 percent to 31.72 percent. Increased investment commitments by the Private sector in the recent period in the Pumped Hydel power and Solar power projects contributed to this positive growth during the Survey period.

The 123 new proposed projects include 61 mega projects with a total investment intention of Rs 1,74,759.40 crore. This includes four Pumped Hydel Power projects, four thermal Power projects and 61 Solar & Wind Power projects. Together, they intend to add a fresh generation capacity of 29,104 MW.

The Infrastructure (Services & Utilities) sector witnessed a decline in both project count and investment value. In Q1/FY2025, 1,629 projects worth Rs 2,78,998.90 crore were announced, compared to 2,144 projects worth Rs 4,32,187.71 crore in Q1/FY2024. This marks a significant decline of 35.44 percent in investment value, reducing the sector’s share in total fresh investment from 49.45 percent to 43.78 percent. The impact of the election was notably pronounced in this sector, which relies heavily on government projects.

The two prominent investors in Roadways projects in Q1/FY2024, Maharashtra State Road Devp. Corpn. (26 projects, Rs 47.394.63 crore) and Mumbai Metropolitan Region Devp. Authority (4 projects, Rs 63,791.51 crore) did not announce any high-ticket projects in Q1/FY2025. Additionally, National Highways Authority of India (NHAI), a major investor in Highways projects, announced only nine projects with a total outlay of Rs 3,380.86 crore in Q1/FY2025. A year ago during the same period, the company had announced 23 highway projects worth Rs 36,914.29 crore. As a result, the total capex intentions in the Roadways sector came down sharply from Rs 1,79,894.37 crore in Q1/FY2024 to Rs 18,164.66 crore in Q1/FY2025.

The election-related restrictions also affected fresh investment announcements in other infrastructure sectors like Railways, Ports, Airports, Power Distribution and Pipelines.

Among the sub-sectors, Real Estate, primarily driven by Private players, defied the declining trends and posted an impressive year-on-year growth of 117.32 percent. As against, 546 projects worth Rs 85,733.31 crore announced in Q1/FY2024, the Survey period saw the announcement of 899 projects worth Rs 1,86,315.55 crore. Around 80 percent of the proposed investment is spread across five states – Maharashtra, Haryana, Telangana, Karnataka and Gujarat.

The Irrigation sector also witnessed a positive growth of 37.72 percent, with 20 new projects worth Rs 9,340.30 crore announced in Q1/FY2025, compared to 36 projects worth Rs 6,782.21 crore in Q1/FY2024.

Projex = Projects Expenditure (Capex)