In the first quarter of the fiscal year 2024, project tendering activities recorded a healthy growth in terms of tender value, despite a decline in the overall number of tenders. This growth can largely be attributed to an increase in the number of mega tenders, contributing to a substantial 32 percent rise in the total value of project tendering.

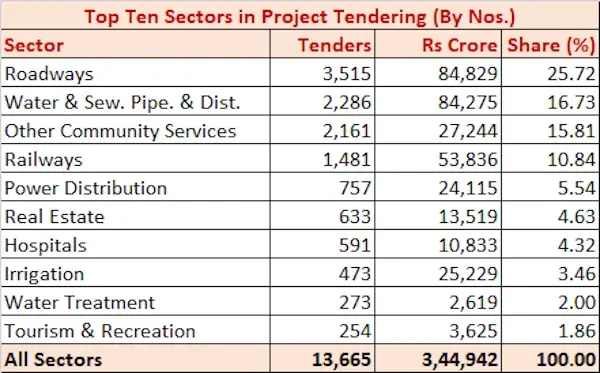

During this period, there were 13,665 tenders worth Rs 3,44,942 crore published, compared to 13,951 tenders worth Rs 2,62,050.28 crore in the same quarter of the previous fiscal year.

The issuance of 32 large-value tenders, each valued at Rs 1,000 crore or more, played a pivotal role, accounting for a staggering Rs 57,161.71 crore or 16.57 percent of the total project tender value in Q1/FY24. For comparison, the previous year’s corresponding period saw 23 large-value tenders with a combined worth of Rs 44,361.06 crore.

Government agencies, encompassing both central and state authorities, experienced a slight decrease of 2.36 percent in the total number of tenders issued, which amounted to 13,336. However, due to the rise in mega tenders, the total value surged to Rs 3,43,858 crore, representing a growth of 32.18 percent. In contrast, these agencies released 13,659 tenders valued at Rs 2,60,140.01 crore during the same period in the previous fiscal year.

On the other hand, the private sector’s contribution remained marginal, with only 292 tenders worth Rs 1,910.27 crore, accounting for a mere 2.09 percent of the total tender value. In the corresponding quarter of the previous year, private companies issued 329 tenders valued at Rs 1,083.42 crore.

Among the major sectors, Services & Utilities (Infrastructure), Irrigation, and Electricity sectors were the frontrunners in tendering activities during this period.

The Infrastructure sector witnessed an impressive growth of 92.32 percent in terms of value, with 12,616 project tenders worth Rs 3,14,123.12 crore floated, compared to 12,283 tenders worth Rs 2,25,852 crore in the same period of the previous year. Leading segments within this sector included Roadways, Water & Sewerage Pipeline & Distribution, and Other Community Services & Railways.

The Roadways sector surpassed the Water & Sewerage Pipeline & Distribution sector to become the top segment in Q1/FY24. It saw the issuance of 3,515 tenders worth Rs 84,829.07 crore, compared to 2,769 tenders worth Rs 70,109 crore in Q1/FY23. Notably, the National Highways Authority of India (NHAI) and the Ministry of Road Transport & Highways (MoRTH) were the prominent players in this sector.

The Water & Sewerage Pipeline & Distribution sector experienced a growth of 56.04 percent in terms of value, with 2,286 tenders worth Rs 84,275.33 crore issued in Q1/FY24, compared to 3,572 tenders worth Rs 54,008.17 crore in Q1/FY23.

The Railways sector registered a healthy growth in both the number of tenders and the aggregate tender value, with 1,481 tenders worth Rs 53,836 crore in Q1/FY24, compared to 677 tenders worth Rs 26,984.18 crore in Q1/FY23.

The Power Distribution sector witnessed an increase from 719 tenders worth Rs 16,227.03 crore in Q1/FY23 to 757 tenders worth Rs 24,115 crore in Q1/FY24.

In the Real Estate sector, 633 tenders worth Rs 13,519 crore were issued during Q1/FY24, compared to 444 tenders worth Rs 7,345.06 crore in Q1/FY23.

The Irrigation sector saw 473 tenders worth Rs 25,229 crore being floated in Q1/FY24, compared to 1,057 tenders worth Rs 25,122 crore in the same period a year earlier.