Dominance of Public Sector

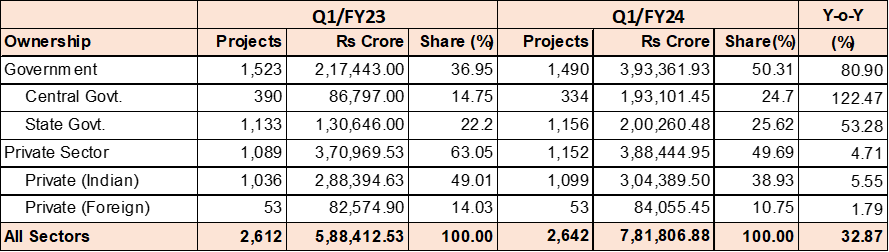

In the first quarter of FY24, the government sector surpassed the private sector in total fresh investment commitments by accounting for 50.31 percent of such investment. This marked a significant shift as the private sector had been dominating fresh investment announcements for the past 13 quarters. After an impressive performance in Q4/FY23, the private sector moderated its investment commitments. During that quarter, the private sector accounted for approximately 72 percent of the total fresh investments. The majority of these investments were directed towards Green Hydrogen, Semiconductors, and Hydel Power projects.

In Q1/FY24, fresh investments by government agencies saw a year-on-year growth of 80.90 percent. These agencies announced 1,490 new projects amounting to Rs 3,93,361.93 crore, compared to 1,523 new projects worth Rs 2,17,443.0 crore announced during the same period a year ago.

On the other hand, during the survey period, the private sector announced 1,152 new projects worth Rs 3,88,444.95 crore, as opposed to 1,089 projects worth Rs 3,70,969.53 crore in Q1/FY23. Though private investment accounted for 49.69 percent of the total new investments, it only grew by a mere 4.71 percent on a year-on-year basis. The major sectors attracting private investment were Food Processing, Electronics, Automobiles, Hydel and Solar power, Ports, Real Estate, and Data Centres.

Government investment commitments, on the other hand, were primarily focused on sectors such as Petrochemicals, Mining, Hydel Power, Water Supply Schemes, Roadways, Power Distribution, and Industrial Parks.

State-wise Investment Trends

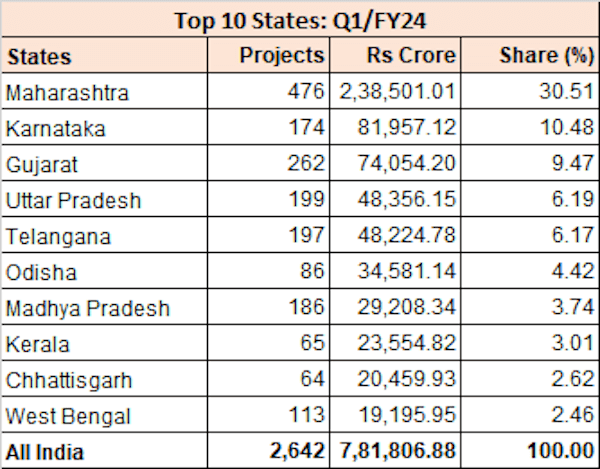

Maharashtra, while consistently being among the top 10 states in terms of fresh investments in most quarterly surveys, rarely claimed the top spot. However, in the quarter ending June 2023, the state ascended to the premier position with 476 new projects worth Rs 2,38,501 crore. This accounted for almost one-third of the total fresh investments announced in Q1/FY24. Among the notable mega projects launched in the state were the Rs 63,426 crore Versova-Virar Sea link project, the Rs 12,482 crore EV project, and the Rs 12,628 crore Industrial Park of MIDC. Additionally, the state also attracted five mega Hydel power projects and Data Centres by Microsoft and Amazon.

Karnataka secured the second rank, attracting 174 new projects worth Rs 81,957.12 crore. The state’s largest investment intention in Q1/FY24 was the Rs 27,000 crore petrochemicals project of the Mangalore Refineries. In Q1/FY23, Karnataka held the leading position in attracting fresh project investments but dropped to second place due to a sharp decline in its share of total investment from 21.99 percent to 10.48 percent. The number of projects also decreased from 244 to 174.

Gujarat managed to maintain its third rank, drawing in 262 new projects worth Rs 74,054.20 crore. Although its share of total fresh investments slightly decreased from 10.69 percent in Q1/FY23 to 9.47 percent in Q1/FY24, sectors such as Electronics, Lignite Mining, Oil Exploration, Hydel, and Solar power attracted substantial new investments. The largest project attracted by the state in Q1/FY24 was the Rs 17,500 crore Metallurgical Grade Silicon & Polysilicon project in Jamnagar.

While Telangana slipped from the fourth rank in Q1/FY23 to the fifth in Q1/FY24 due to a decline in the number of new projects and investment commitments, Uttar Pradesh, a northern state, managed to improve its rank from fifth a year ago to fourth in Q1/FY24. The state witnessed the announcement of 19 Ethanol projects, a dozen Highways, and two high-value Hydel-based power projects.

Outlook for FY2024

The Indian economy is projected to grow at around 6 percent in the next couple of years. This growth is expected to provide the necessary momentum for grounding the announced capital expenditure intentions, especially in emerging sectors like Green Hydrogen, Semiconductors, Electric Vehicles, and Non-conventional power. Faster implementation of projects in these sectors will attract foreign companies to invest in India, particularly technology companies seeking high-growth, large-scale markets to expand their reach and global presence.

We anticipate that the pace of fresh investment announcements by the Indian private sector will remain positive throughout the remaining quarters of FY2024. Furthermore, we expect the private sector’s project implementation ratio to improve. Currently, this ratio stands at 30.92 percent compared to the 36.55 percent observed in the public sector.

From the government’s perspective, we anticipate continued efforts to enhance the ease of doing business, an extension of the PLI scheme, and accelerated implementation of key infrastructure projects worth Rs 5.14 lakh crore planned under the PM Gati Shakti National Master Plan.