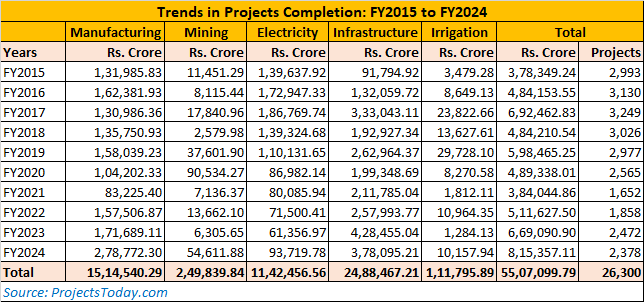

Over the last two decades, there was a notable shift in the allocation of investments towards Infrastructure, with massive growth in absolute terms and its share in total investment. Sectors like Manufacturing and Electricity also saw significant increases in their investment levels. The mining sector saw a steep rise in investment, although starting from a smaller base.

During the first decade (FY05-FY14), the country saw completion of 27,781 projects worth Rs 21,72,737 crore. In the following decade (FY15-FY24), 26,300 projects were completed, totalling Rs 55,07,100 crore, indicating a shift towards higher-value projects. Compared to the previous decade, the recent decade saw a significant increase of 153.46 percent in actual investment, with an additional Rs 33,34,362.59 crore invested.

Actual investment in the form of mega projects (Cost Rs 1,000 crore or more) almost tripled in the latest decade vis-à-vis the preceding decade. As against 303 mega projects worth Rs 9,70,279.77 crore completed in Decade-1, 793 projects worth Rs 27,09,439.48 crore were commissioned in Decade-2.

Manufacturing

During Decade-2, the Manufacturing sector saw the completion of 7,327 projects with a total investment of Rs 14,14,540.29 crore. Compared with the previous decade, this marked a growth of 97.96 percent.

Within the Manufacturing sector, sub-sectors like Food Processing, Pharma, Petrochemicals, Cement, Steel, Machinery, Electronics, Automobiles and Defence saw increased project fructifications.

While Food processing saw the completion of projects worth Rs 95,948 crore, the Pharma sector saw completion of 741 projects worth Rs 54,304 crore. Around 230 projects were for manufacturing Active Pharma Ingredients to minimize the dependency on China for critical raw materials.

In the Basic Chemicals sector, the decade saw the completion of 11 Petrochemicals projects worth Rs 97,348 crore, and 11 Refinery Projects worth Rs 1,14,246 crore. In both segments, the bulk of the mega investments were carried out by Public Sector companies like ONGC, IOCL, HPCL, BPCL, GAIL, Mangalore Refinery, etc. Among the private players, Reliance Industries was the largest investor. Across four mega projects, the company invested Rs 27,950 crore.

The Cement sector saw completion of 263 projects worth Rs 1,02,564 crore. Of these, 37 projects commissioned by Ambuja Cement, Dalmia Cement, J K Cement, Shree Cement, and UltraTech were of large capacities and involved a total capex of Rs 64,593 crore.

In the Basic Metals segment, project completion in the Steel sector increased by 140.55% over the last decade, and project completion in the Aluminium sector remained at par with the Decade-1 figures. As against 49 aluminium projects worth Rs 47,807.85 crore completed in Decade-1, 60 projects worth Rs 47,395 crore were commissioned in Decade-2. Of the 729 steel projects completed in Decade-2, 42 were of mega size with an investment of Rs 2,72,206 crore. The heavy investors in this sector were BMM Ispat (Rs 17,655 crore); JSW Steel (Rs 32,700 crore); NMDC (Rs 41,500 crore); Steel Authority of India (Rs 51,805 crore); and Tata Steel (Rs 21,049 crore).

Automobiles sector registered a 77.94 percent increase in actual investment during Decade-2 when compared with the preceding decade. As against 99 projects worth Rs 59,034 crore completed in Decade-1, 135 projects worth Rs 1,05,044 crore were commissioned in Decade-2.

Fiat India Automobiles, Ford India, Kia Motors India, Maruti Suzuki India, Mercedes-Benz India, MG Motor India. Suzuki Motor Gujarat, and Tata Motors were the major investors who invested around Rs 40,000 crore to manufacture passenger cars. Hero MotoCorp, Ola Electric Mobility, Bajaj Auto, India Yamaha Motor, Honda Motorcycle & Scooter India and, TVS Motor Co. invested around Rs 12,000 crore to manufacture 2-wheelers including electric variants.

The decade also witnessed the setting up of mega electronic plants to assemble smartphones by Oppo, Samsung, Wistron and Pegatron.

The decade also witnesses the entry of the Private sector into Defence equipment manufacturing. In all 16 projects were commissioned. Of this, a Rs 4,500 crore Self Propelled Guns project of Larsen & Toubro, a Rs 1,550 crore ammunition project of Solar Industries India and a Rs 1,500 crore ammunition project of Adani Defence & Aerospace.

Mining

Heavy investment in Oil & Gas Exploration by both the Public sector oil giants like ONGC, Reliance, Nayara Energy, and Vedanta in the second half of the Decade-2 and expansion plans of Coal India and its subsidiaries raised the overall investment in the Mining sector by around 5.5 times from Rs 46,003 crore in Decade-1 to Rs 2,49,840 crore in Decade-2.

Power

Decade-2 saw the entry of the Private sector into the Non-Conventional power sector (Both Solar and Wind Power). In the Conventional power sector (Hydel, Thermal and Nuclear), the Central and State power generation companies accounted for most of the actual investment. They commissioned 169 power projects at a total investment of Rs 4,92,106 crore, accounting for 62.18 percent of the actual capex that took place in Decade-2. On the other hand, the Private sector commissioned 127 Thermal & Hydel power projects at a total investment of Rs 2,99,280.37 crore and accounted for 37.8 percent of the total investment took place.

In the Non-conventional sector (Solar & Wind), Private participation increased sharply. Of the 1,141 projects worth Rs 3,51,070 crore commissioned, 875 projects worth Rs 2,50,306 crore were by private promoters. In other words, the private sector owned around 78 percent of the total investment that took place in the non-conventional power sector.

Infrastructure

The extra thrust by the current central government on Infrastructure building saw not only the fresh investment announcements in this sector increasing sharply but also the pace of project execution. As a result, during the last ten years, 17,017 infrastructure projects worth Rs 24,88,467.21 crore were commissioned, indicating a three-fold increase in actual capex compared with the Rs 7,81,752 crore invested in Decade-1.

Within the Infrastructure sector, sub-sectors like Community Services, Hospitals, Roadways, Railways, Airports, Construction, Power Distribution, Communication, and Data Centres saw a good amount of actual investment in Decade-2.

In the post-COVID period, around fifteen AIIMS were set up by the Central government across the country at a total cost of Rs 18,232 crore. The bulk of the investment in this critical sector was invested by the Central and State government agencies. The private sector accounted for around a quarter of the total investment that took place in Decade-2.

Decade-2 saw the completion of 3,519 road projects at an aggregate cost of Rs 8,45,373 crore. Compared with a decade ago figures, it indicates 4 times increase in actual investment. Of the 3,519 projects, 223 roadways projects were of mega-size with a total investment of Rs 4,33,421 crore. The National Highway Authority of India (NHAI) completed 307 projects by investing Rs 1,87,024 crore. Of this, 65 projects were of mega size.

Thanks to the eight mega Metro Rail projects, the Railways sector also registered an impressive capex implementation performance in Decade-2. In all, the sector saw completion of 336 projects with a total capex of Rs 2,65,682 crore. The decade also witnessed the completion of 93 Airport projects (Rs 71,347 crore) and 104 port expansion projects worth Rs 33,787 crore.

In the Construction sector, while the Commercial Complexes and Industrial Parks sectors recorded impressive growth in capex commissioning, the resurgent in project investment in the Real Estate sector was phenomenal. The increase in demand for housing in Tier-1 and Tier-2 cities saw the actual investment of Rs 2,32,772 crore in Decade-2 as against Rs 30,123 crore investment took place in Decade-1. The decade also saw the rise in the number of townships, and luxury and high-rise buildings.

The Decade also witnessed the setting up of 54 Data Centres across the country. Some of the large players who set up large-size Data Centres include Amazon Data Services, Colt Technology Services, Netmagic Solutions, Adaniconnex, Yotta Infrastructure Solutions, etc.

Irrigation

Irrigation projects are notorious for cost and time overruns in India. Notwithstanding this, Decade-2 saw the completion of 245 large and small irrigation projects with a total investment of Rs 1,11,796 crore. Of this, 35 were mega projects.