Samir Ashta,

Samir Ashta,

Director – Finance and Chief Financial Officer,

CLP India Pvt. Ltd

CLP Power India Pvt. Ltd, a subsidiary of the HK$38.5-billion China Light and Power Ltd, Hong Kong, is the largest foreign investor in the Indian power sector. The company’s strategy is to develop a portfolio of investments across various segments of power industry and become a significant player in the Indian electricity market. Samir Ashta, Director – Finance and Chief Financial Officer, CLP India Pvt. Ltd, shares his views on the Indian power sector with emphasis on its renewable energy business.

To begin with, can you share your outlook for the Indian power sector?

The power sector, as we all know, is going through one of its most challenging phases with various areas critical for its operations and growth struggling for revival. The two core areas that need urgent attention are fuel, both coal and gas, and financial health of distribution companies. While we have seen some positives in both these areas over the past few months, sustainability and continuous improvement are absolutely vital for the sector to stabilise and resume growth. Unlike coal that has seen some improvement in supplies over the past few months, there is no respite on natural gas, which has severely impacted gas-based generation.

Having said all this, we remain cautiously optimistic about the future for this sector in India, as we believe that the power sector’s dynamics will improve over a period of time, although at a slow pace.

What is your company’s investment plan for the current year?

We are already the largest investor, foreign or domestic, in wind energy in India and we will continue to grow this part of our portfolio. Our belief in wind energy has been quite strong over the past three-four years, which reflects in the sustained growth of our wind portfolio in India that stands at over 1,000 MW today, almost one-third of our total capacity in India.

Wind is also an integral part of our business philosophy and is expected to make a vital contribution to our growth plans. As we have over the past few years, we plan to continue adding 250-300 MW worth of wind projects to our portfolio every year.

Tell us about the paradigm called ‘pooled financing’ introduced by CLP recently.

Tell us about the paradigm called ‘pooled financing’ introduced by CLP recently.

Wind power projects are typically project-financed, which means that the lenders lend to a particular project. In the ‘pooled financing’ structure, the security of each project continues to be pledged to the respective lenders of that project. However, the primary feature of the pooling arrangement with three leading financial institutions, Standard Chartered Bank, IDBI Bank Ltd and IDFC, is to make the cash generated from the pooled projects available to all the lenders in the pool. As such, if one project in a particular year is faced with a stressed situation due to low wind or other factors, due to the portfolio effect, cash from other projects is available to mitigate the risk. The portfolio effect created by this structure will result in a significant reduction of risk.

With the introduction of new pooled financing, financial covenants and defaults will no longer be measured at the individual project level.

Some of other benefits of pooled financing are:

* Extract maximum value from both debt and equity investors

* Ensure security for lenders as pooled cash flow would be accessible to all lenders

* Mitigates typical project level risks such as variability of wind

* Fuel CLP India’s future growth as excess money from the pool can be accessed efficiently and used to fund additional projects

* Enhance CLP India’s ability to attract new lenders, particularly ECB lenders

* Standardised documents for rapid fund raising

While CLP Group is developing wind energy projects in India, does it intend to take up solar power and other renewable energy projects?

Renewable energy has been an integral part of CLP’s business philosophy and is expected to continue making a vital contribution not only to CLP’s growth plans but also to its commitment to reducing its CO2 emissions. Wind energy has been an area of keen focus for us at CLP India over the past few years, and with a sustained expansion by 250-300 MW every year, we currently own the largest wind portfolio in India with a total capacity of over 1,000 MW.

Like wind, solar fits in very well with our business philosophy and we are evaluating opportunities in this space at the moment. We do see ourselves making a small but important start in this space over the next couple of years. With our 64-MW grid connect solar plant in Thailand, we have strong in-house expertise and will look to leverage it for evaluating/seizing opportunities in India. As an initial step towards developing solar projects, we have started monitoring solar resources at three locations to capture more reliable site specific solar radiation data.

Tell us about the projects which are in the pipeline as well as those currently being executed by CLP India.

CLP India is one of the largest foreign investors in the Indian power sector with a total committed investment of over Rs.14,500 crore. This investment is spread across a diversified and environment-friendly generation portfolio that covers renewable energy, supercritical coal and gas fired power plants, amounting to over 3,000 MW.

In the conventional space, CLP India has been operating a 655-MW gas-based power plant (Paguthan CCPP) in Bharuch, Gujarat, since 2002. This power plant was one of the first independent power projects in India. Paguthan CCPP is equipped with 3×138 MW gas turbines and 1×241 MW steam turbine generating units. CLP India also owns and operates a 1,320-MW (2×660 MW) supercritical coal-fired power plant in Jhajjar, Haryana, which is the largest power plant of its kind in CLP’s generation portfolio in Asia-Pacific and is one of India’s first and largest supercritical coal-fired power plants.

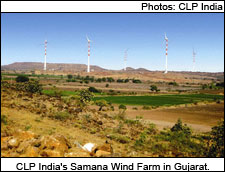

In the renewable space, CLP India is one of the largest wind power developers in India with committed wind projects of over 1,000 MW that are spread across five states. Wind is an integral part of CLP’s business philosophy and is expected to continue making a vital contribution not only to CLP’s growth plans for India but also to its commitment to reducing its CO2 emissions. CLP India will also continue to invest in the Indian wind energy sector and support the company’s commitment to adding 250 to 300 MW of wind projects every year.

What is CLP India’s strategy for the 12th Five-Year Plan?

Insofar as our renewables energy portfolio is concerned, as mentioned earlier, we will continue to add 250-300 MW of wind energy to our portfolio every year, as we have done over the past three-four years and will evaluate opportunities in solar. We believe that in developing countries such as India and China, renewable energy will play a vital role in helping achieve energy security, as conventional energy, with its own set of issues, will be way too inadequate.

On the conventional part of our portfolio, we do not have any immediate expansion plans, as the sector is struggling with one of the most fundamental issues of fuel availability/supply. We will, however, continue to watch this space carefully and consider resuming our business development efforts as and when the dynamics stabilise.