Around 95 per cent of India’s foreign trade by volumes, which amounts to a sizeable 70 per cent by value, is carried out through ports—major, minor and private—across India’s long and winding coastline. The efficiency at the ports has an important bearing on the transaction cost of shipping lines. In recent years, the major ports have improved their operational efficiency particularly in terms of turnaround time. TRT is the total time spent by a ship at the ports from its entry until its departure.

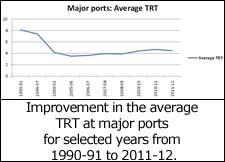

The Ministry of Shipping’s Annual Report for 2012-13 states that the average TRT for all major ports improved from 8.10 days in 1990-91 to 4.47 days in 2011-12. During 2011-12, the TRT ranged between 1.82 days at Cochin Port to 6.42 days at Kandla Port. Amongst the 12 major ports, improvement in TRT during 2011-12 in comparison to 2010-11 was discernible in most of the major ports except four ports, namely V.O. Chidambaranar, New Mangalore, Mormugao, and Kandla.

A recent KPMG report titled ‘Adding Wheels’ pointed out that the average TRT at Indian ports was 84 hours vis-à-vis seven hours in Hong Kong and Singapore. India’s annual container handling capacity at ports was a measly 8.4 million TEUs compared to China’s 60 million TEUs. Even the maximum average containers handled per ship, per hour across Indian ports stood was around 15 vis-à-vis global average of 25-30, the report added.

According to Indian Ports Association data, the 12 major ports handle around 75 per cent of external trade by volumes. Although the major ports are cheaper vis-à-vis private ports they remain notorious for having a high turnaround time due to inefficiency.

According to Indian Ports Association data, the 12 major ports handle around 75 per cent of external trade by volumes. Although the major ports are cheaper vis-à-vis private ports they remain notorious for having a high turnaround time due to inefficiency.

Carsten Wendt, Team Leader – Key Accounts & Project Sales, Rickmers-Linie GmbH & Cie. KG, said, “Port congestion remains a challenge in India and is an issue. There are few ports on India’s east and west coasts and they remain congested. Being a liner carrier, it is difficult for us since we have to go to a port and wait for five to seven days which totally destroys our planned schedule. Therefore, we have to pick and choose our ports carefully.”

Carsten Wendt, Team Leader – Key Accounts & Project Sales, Rickmers-Linie GmbH & Cie. KG, said, “Port congestion remains a challenge in India and is an issue. There are few ports on India’s east and west coasts and they remain congested. Being a liner carrier, it is difficult for us since we have to go to a port and wait for five to seven days which totally destroys our planned schedule. Therefore, we have to pick and choose our ports carefully.”

Percy Bilimoria, Chief Operating Officer, United Liner Agencies of India (P) Ltd, explained, “The congestion at Indian ports is due to many reasons such as seasonal; therefore, one needs to plan one’s shipping and at times it can’t be avoided. Certain priorities given by the government are not fair. Other export or even import cargoes are not encouraged and it’s always the government cargo that has priority.”

Comparing the Indian situation with other global ports G. Kannan, Head – Logistics Management Centre, Larsen & Toubro Ltd, noted, “Normally the turnover time at Singapore port is only 12 hours; this is around 2.5 to three days in India. This is very bad. All the costs are being borne by Indian shippers; therefore, our logistics costs are much higher; nearly 13 per cent of India’s GDP compared to around 6 or 7 per cent in Europe.”

Comparing the Indian situation with other global ports G. Kannan, Head – Logistics Management Centre, Larsen & Toubro Ltd, noted, “Normally the turnover time at Singapore port is only 12 hours; this is around 2.5 to three days in India. This is very bad. All the costs are being borne by Indian shippers; therefore, our logistics costs are much higher; nearly 13 per cent of India’s GDP compared to around 6 or 7 per cent in Europe.”

Private ports vis-à-vis major ports

Private ports across India face lesser congestion issues due to higher efficiency but then these ports also charge a higher premium for their services vis-à-vis major ports so the overall cost of usage is higher.

There is less congestion at private ports in India but then these private ports are also more expensive, Carsten Wendt agreed.

Sharmila Amin, Regional Director and COO India, Bertling Logistics India Pvt. Ltd, felt that private ports would not take away business from major ports because Indian customers are price sensitive; they always look at the costs. The major ports will compete with private ports and then change to match the private ports. Thereafter, private ports may reduce prices to match government ports.

Percy Bilimoria observed that sometimes if customers want their cargoes to be delivered quicker then one has to go to private ports but then the freight rates would also be higher.

Percy Bilimoria observed that sometimes if customers want their cargoes to be delivered quicker then one has to go to private ports but then the freight rates would also be higher.

Pointing to the aggressive strategy of private ports that make it viable, G. Kannan explained that the tariff of Hazira Port was at par with Mumbai Port because the former had given special concession to L&T. Hazira wanted to promote the port and was therefore keen that L&T used their port. Hazira Port also provided L&T with specialised services which others did not get. This was done to ensure that L&T did more business, both imports and exports, with Hazira Port.

Evolving scenario

Evolving scenario

Sharmila Amin was of the opinion that the current congestion witnessed at Indian ports must reduce or else the people would get angry. However, currently, there was no congestion except at JNPT because business and overall economy had slowed down. “Congestion is not because of inefficiency, it is because of labour problems, vehicle problems, and lack of last mile connectivity at ports,” she added.

The current slowdown in the Indian economy has led to reduced traffic at ports thus leading to lower congestion. But as the economy improves, the issue of congestion at the ports will crop up again until a permanent solution is implemented.