Projects Investment Survey 90

India witnessed a significant surge in project investment across major sectors in the fiscal year ended on 31 March 2023 (FY2023). As per the latest Survey of Projects Investment in India, fresh investment increased by a whopping 91.97 percent in FY2023 on a Y-o-Y basis. While sectors like Roadways, Solar Power, and Real Estate continued to attract increased fresh investments, new industries in Green Hydrogen, Semiconductors & Display Fabs, Electric Vehicles, and Data Centres attracted high-ticket investment intentions.

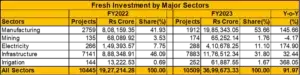

Fresh investment swelled from Rs 19,27,214.28 crore in FY2022 to Rs 36,99,673.33 crore in FY2023. During the same period, the total number of projects increased from 10,445 in FY2022 to 10,509 in FY2023.

Projex by Sectors

Barring the mining sector, growth in fresh investment was seen across major sectors. The Manufacturing sector replaced the traditional leader, the Infrastructure sector by attracting 53.66 percent of the fresh investment announced in FY2023. Electricity and Irrigation sectors too saw total fresh investment commitments increasing at handsome rates in FY2023.

Manufacturing

The Manufacturing sector has emerged as the dominant sector in terms of investment, with its share in total fresh investment increasing from 41.93 percent in FY2022 to 53.66 percent in FY2023. New projects outlay in the sector more than doubled, from Rs 8,08,159.35 crore in FY2022 to Rs 19,85,343.05 crore in FY2023. On the flip side, the number of new projects declined from 2,759 in FY2022 to 1,912 in FY2023.

The substantial increase in investment commitment seen in this sector can be attributed to the rise in the number of mega projects (Cost Rs 1,000 crore or more). As against 98 mega projects worth Rs 6,00,205.60 crore announced in FY2022, in all, 132 mega projects worth Rs 18,05,540.56 crore were announced in FY2023. Within this sector, sub-sectors like Food processing, Pharmaceuticals, Green Hydrogen & Ammonia, Electronics, and Automobiles sectors saw a healthy surge in fresh investment. On the other hand, sectors like Petrochemicals, Steel and Cement, which had attracted large sums of fresh investment in FY2022, registered declines in FY2023.

The forty-two new Green Hydrogen & Ammonia projects and nine Semi-conductors and Display Fabs projects announced during FY2023 together accounted for 34.27 percent of the total fresh investment announced during the Survey period.

In the Automobile sector, 45 new Electric Vehicle projects were announced. These projects intend to install capacities to produce two-wheelers and four-wheelers including buses at a total investment of around Rs 65,000 crore.

Infrastructure (Social & Transport)

During the Survey period, investment commitments in the Infrastructure sector grew from Rs 8,88,348.91 crore in FY2022 to Rs 11,76,512.34 crore in FY2023. The number of new projects also increased from 7,141 to 7,883. However, the unprecedented surge in investment in the Manufacturing sector pulled down the share of the sector from 46.09 percent in FY2022 to 31.8 percent in FY2023. For the last nine years, the share of this sector in total fresh investment had remained above 45 percent.

Within the infrastructure sector, Roadways, Real Estate, Data Centres and Water Supply sectors accounted for around 70 percent of the total fresh investment announced in the Infrastructure sector and for around 22 percent of the total fresh investment announced in FY2023.

Highways/roadways building activities by the NHAI, and various state agencies gained velocity in FY2023. In all, 1,702 new roadways projects entailing a total investment of Rs 4,27,954.76 crore were announced. A year ago, the sector had attracted 1,611 projects worth Rs 2,51,795.83 crore. NHAI alone announced 212 new highway projects with an investment commitment of Rs 1,69,375 crore. A Rs 22,000 crore, 179.71 km Jalna-Nanded expressway of MSRDC was the largest highway project announced during the Survey period.

Increased capex intentions by the state government agencies saw fresh investment commitments in the critical Water Pipeline and Distribution schemes increasing by 38.31 percent in FY2023 on year-on-year basis. In all, 1,106 new projects worth Rs 1,19,583.34 crore were taken up in this sector. At the state level, the year also saw announcement of increased number of schools, hostels, and medical colleges.

In the Railways sector, though not many high-ticket railway line projects were seen, 335 railway station modernization projects were announced. In most of these projects, the costs have not been firmed up. We estimate a total sum of around Rs 15,000 crore will be spent on these projects.

In the Construction industry, barring the Real Estate sector, other sectors like Commercial Complexes and Industrial Parks did not saw much appreciation in fresh investment vis-à-vis a year ago situation. In the Real Estate sector, 1,469 new projects worth Rs 2,12,961.9 crore were announced in FY2023 as against 1,540 projects worth Rs 1,62,235 crore indicating a growth of 31.27 percent on a Y-o-Y basis. Of the 1,469 new projects, 30 were large-size residential complexes, with an aggregate investment of Rs 55,048 crore.

In FY2022, a number of software service providers (including foreign entities) announced their intentions to set up large-size Data Centres in India. The trend continued in FY2023 too. During the Survey period around 45 new Data Centres with an aggregate investment outlay of Rs 59,618 crore were announced. Most of these centres will be housed in Maharashtra, Telangana, Tamil Nadu, Delhi, Odisha, and West Bengal.

Electricity

The Electricity sector saw its share in the investment pie growing from 7.75 percent to 11.1 percent following the 174.9 percent growth recorded in fresh investment intentions. Fresh investment grew from Rs 1,49,393.57 crore in FY2022 to Rs 4,10,678.25 crore in FY2023. While the bulk of the investment in this sector has come in the form of new Solar Power projects in recent years, FY2023 witnessed the revival of interest of promoters in setting up Hydel Power projects. As a result, the fiscal saw announcement of 79 new Hydel power projects worth Rs 1,75,296.71 crore as against 18 projects worth Rs 52,975.33 crore announced in FY2022. Around 33 of the new hydel projects are by Indian private companies.

Solar Power continued attracting new investors and the Survey period saw investment commitment of Rs 1,74,373 crore in the form of 152 projects. Interestingly, the year also saw announcement of 10 Solar-cum-Wind hybrid projects with a combined generation capacity of 10,265 MW.

Irrigation

The Irrigation sector, where State government investment dominates, has seen its share rise from 0.69 percent to 1.67 percent, and fresh investment increasing from Rs 13,222.53 crore in FY2022 to Rs 61,887.55 crore in FY2023. The number of projects too increased from 144 to 252. Further, of the 15 mega projects announced in this sector, 12 projects worth Rs 29,228.15 crore were in Madhya Pradesh. Narmada Valley Development Authority of Madhya Pradesh announced 10 new multi-purpose micro irrigation projects entailing a total outlay of Rs 18,512 crore and the Water Resources Department of the state announced 19 new projects worth Rs 16,145 crore.

Mining

The Mining sector, where investment increased by an impressive rate in FY2022, recorded a marginal decline in projects investment in FY2023. Investment in the form of new projects declined by 4.17 percent, from Rs 68,089.92 crore to Rs 65,252.14 crore. During FY2023, the sector saw announcement of 83 new Coal mining projects worth Rs 22,500 crore and 22 Iron ore mining projects worth Rs 18,245 crore.